To Win Now with Gold and Silver, “You’ve got to Shut out the Doubt”

An Interview with David Morgan and David Smith

This month we begin the “educational” part of our letter with an excellent communiqué from our long-time friend and associate, David Morgan, of The Morgan-Report/Silver-investor.com. Known to his many admirers as the Silver Guru, he speaks at conferences in North America, Europe and Asia. David, in collaboration with Chris Marchese has recently published his second book on silver, titled The Silver Manifesto, which you can order here.

As David says in his new book, There are factors that produce immense profits and these occur but rarely. Investors stand at a unique point in monetary history where the death of paper currencies on a global scale is taking place before their eyes.

We know it’s been a struggle since 2011, and as David likes to say, “the corrections in a precious metals’ bull market will either wear you out or scare you out.” Part of our job here at Resource Consultants (800-494-4149) is to give you the support you need to make informed decisions as to how to protect a portion of your wealth from the continued ravages of government mismanagement, massive debt creation, and (highly) understated inflation.

We also know that those of you who have continued to dollar-cost average your purchase of precious metals from us – whether on a regular monthly basis, or whenever you’ve got some extra paper currency to exchange for real money – gold, silver and palladium, you are probably now sitting on a lot more ounces than you would have if you had simply stopped buying when prices made their intermediate top in May, 2011.

WE think you will find David Morgan’s brief, but powerful comments below to be a real morale booster, as we watch the next leg up of the secular bull market in silver and gold get underway. Says David:

The dollar appears to be the strongest paper currency available. Investors all over the globe are fleeing INTO the dollar from the Euro, the Ruble and almost any currency you care to name. Even in the BRICS countries, Argentina’s currency has been one of the weakest during the last couple of months.

Therefore, the dollar keeps going up, up, and up. And it will continue to do so, as long as investors continue to believe it is a safe haven asset class.

However, the truth is that gold is the ultimate money, not the dollar. And once the market determines that this is a fact, you will see a run into gold like we have never seen before. This is the simple and succinct way of looking at monetary history.

The ability for investors to perceive the future is very unlikely, as most people are herd-instinct animals, and will follow the herd – without ever considering critical thinking.

However, those few who are above the herd – the leaders – the people who really understand what’s going on, are already positioning themselves in the precious metals, for what will become the longest, strongest, most dynamic bull market in the history of mankind. Don’t worry folks, the best is ahead. It’s only a matter of time.

Thank you, David Morgan!

…………………………………………………………………………………………………………………………………………

Readers of our newsletter over the last few years should be well-acquainted with one of our frequent contributors, David H. Smith. David is Senior Analyst and frequent contributor at The Morgan Report. When Dr. Dorn and Pat were working on the book Personal Responsibility: The Power of You – David contributed a chapter, and he has presented at several of our Wealth Preservation Conferences. He and I were able to get together on a conference call recently, and I posed some question for him. I think you will find his response along with commentary of my own, to be helpful in keeping you informed – and optimistic (!) about what’s in store for the precious metals – perhaps a lot sooner than you might expect!

Linda Gorman: Hello David. It’s a pleasure to speak with you today.

David H. Smith: I fully agree, Linda! Here we are I believe, on the very cusp of a new bull run in gold and silver, which we at The Morgan Report feel, over the next few years, will take the metals to new all-time highs, making today’s prices in retrospect look like real bargains!

Linda: People have become pretty discouraged over the last few years as metal’s prices seem to get cheaper and cheaper, in spite of what we all know is very strong demand for them from investors, industrial users and Central Banks. Should we expect more of the same, or are there valid reasons to expect things to change to the better for precious metals’ holders?

David: I fully understand why a lot of investors have all but given up hope that the things we are discussing today will EVER take place. We have been chewed up over the last few years as metals’ prices and mining stocks dropped further and stayed down longer than almost anyone thought possible. The entire resource sector has been decimated, with even the best producers dropping 60-70% in share price. A lot of exploration companies have gone out of business, with more likely to do so later this year.

But here’s the thing. Mining stocks and precious metals’ prices are cyclical. That means that they move up and down in price at fairly regular intervals. Yes, it’s hard to remember that a few years ago, gold was trading briefly for $1,900 per ounce and now it’s clinging on to just $1,200. But it’s also easy to forget that, 10 years before, gold was under $300. So even today, the price is still four times higher.

When we factor in inflation, the case for owning gold and silver today is really compelling. David Morgan’s research indicates that $16 silver today is equivalent to $5 silver at the beginning of its secular bull market that started around 2003. So if you believe that the bull run is far from over – which we certainly do – then today’s market is presenting us with a “second chance” to get in or add more metal at what can best be described as “beginning-of-the-bull-market prices”.

When I see a one-mine company that sold for $10 four years ago – now with a second mine in the pipeline – selling last week for .26 CENTS; or a world-class gold/silver producer at $18 that was going for $52; not to mention a heading-for-production Yukon gold stock that was $5, and now goes for just .65 cents – then I am compelled to pay attention, and consider taking action. More to the point about your customers at Resource Consultants, many of whom probably do not care about holding mining stocks – which are certainly more volatile and risky than the physical metals themselves, the distress in the mining sector is going to have an impact on new metals’ supply – Raising the question of how much there will be, and eventually, IF there will be anywhere close to enough supply to handle demand.

Money Markets Will Change Next Year – Big Time

Something that not many people are aware of, is that going into next year, some big changes are going to be taking place in an old standby investment vehicle that tens of millions of Americans depend upon – the “solid as a rock” money market fund industry. There is almost $3 trillion dollars in “parking money” stored there. People see money markets as absolutely safe since their NAV – Net Asset Value – always remains at $1/share – thus avoiding “breaking the buck – and that your money can be withdrawn whenever you need some or all of it.

If you go to FDIC.gov here you will see that indeed these funds are still currently insured:

FDIC-Insured:

Checking Accounts (including money market deposit accounts)

Savings Accounts (including passbook accounts)

Certificates of Deposit

But as of October, 2016, while FDIC insurance may still apply, the Security and Exchanges Commission (SEC) has announced that the value of a money market share will “float”. Thus the customer may believe that he or she is simply depositing their money into a depository account, but what they are actually doing is buying a share of the fund with each dollar that they deposit. Upon your decision to redeem it, that share may not be worth a dollar. This money will now also potentially become available for use by the fund managers themselves – in effect your dollars will be comingled with those of the firm whose name is on your account.

You will be charged withdrawal fees, and the funds can temporarily block withdrawals when they “are under pressure”. If the fund is in danger of becoming insolvent, they can use your money to pay themselves first. You will thus have the privilege of participating –whether you want to or not – in a “bail in” – language now being increasingly written into the agreement language for depository accounts in banks large and small.

Some large banks are already converting their money market accounts into funds that invest only in government securities. This is in effect, the beginning of forced investment into U.S. treasuries. Over time, the federal government will have access to the money which now resides in your money market account. The upshot of all this is that your funds will now be commingled with that the bank where you do business.

“Dark” markets…and dark operators

You’ve probably heard about so-called “crypto-currency”. There are a number of them out there, but the most well-known and widely used is Bitcoin. This “currency” only exists in digital form and is used in a number of online trading platforms. Though some of the largest companies in the U.S. and Europe accept it in buying/selling of their products, it is still far from entrenched as a reliable form of exchange with a reasonably predictable value affixed to it. It first started with a value of – literally, several cents – then rocketed up a few years ago to over $1,200 apiece, and now trades in the $250 area. Several large Bitcoin exchanges have gone under in the last couple of years, due to mismanagement, fraud and in some cases, outright criminal activity. Most recently, “Evolution Marketplace” – “dark web” site trafficking in drugs and other illegal goods, shut down, apparently spiriting away with an estimated $12 million in Bitcoins. The Administrator, in a message that sounds like it may have been written after he ingested some of the drugs he was selling, stated laconically:

Due to unforseen events I decided to close down Evolution Marketplace. We want to thank you guys for your effort and help making this the most profitable and popular marketplace. This wasn’t an easy decision but due to other marketplaces getting shut down and the forum going downhill I decided to cut my ties and exit with an eight figure profit. The millions from evo will be divided up amongst the mods a few admin and members. Since this is such an abundance of money I may consider buy ins from former evo members in exchange for 1k bitcoins. I’ll be around for a short period of time before permanently moving to the caribbeans (sic), I hope you guys understand.

Linda: David, your colleagues at The Morgan Report, David Morgan and Chris Marchese recently wrote The Silver Manifesto. One major theme is the “Debt Bomb.” Could you explain why investors should care about it?

David: The Silver Manifesto’s discussion of The Debt Bomb was written to inform all readers – from those new to the silver story through “precious metals’ veterans”. David and Chris wanted to build a philosophical and practical framework for discussing the unusual potential of silver going forward. Having said that, I would suggest – given that many of your readers are well grounded in the elements of the massive overhang of government liabilities and banking derivatives world-wide – “The Debt Bomb” as it were – that the most critical thing now is to become prepared – laying in some precious metals and considering a few carefully selected mining stocks. Some of us have been criticized –perhaps rightly so… at least for now – for having sounded the alarm too early, but I think it is the height of folly for ANYONE to think they can “wait until the debt bomb explodes” and then take action. Go against your emotions now and buy some insurance, rather than wait until the financial house is on fire.

Linda: What are some examples of events that might be likely to set it off?

David: I like Jim Rickard’s “snowflake” analogy, wherein a rather small event could start an avalanche and bring down the whole mess before the Central Banks could react. It certainly could be something relatively large like Greece leaving the Eurozone, a shooting war between the U.S. and Russia in Ukraine, or a depositor bank run caused by a major European or U.S. bank going under. (BTW, right now banks in Crete and Greece are experiencing 5x normal withdrawals of Euros.). OR it could be something that in retrospect was not seen as “a big a deal” – like the 1931 failure of the Creditanstalt Bank in Austria – which historians credit with starting a global panic and ushering in the Great Depression.

Central Banks think they can control bank runs or a credit contraction by pumping money into the system, or capital controls, but they are playing with fire. As evidence, I would point to an excellent study done by Dr. Antal Fekete a few years ago (not long before the 2008 crisis by the way), where he demonstrated that it was entirely possible to have hyperinflation (with the price of derivatives spinning out of control) and deflation –where money/credit drained from the system so fast that it overwhelms Central Banking ability to cope.

With the speed of Internet communications nowadays, I don’t see how most of us will be able to “see it coming” and take action. Markets trade 24/7. We could go to bed one night and wake up the next morning staring at a global collapse. Would any of us have the courage to buy silver $10 higher and gold $200 higher on that day? – IF you can find any?

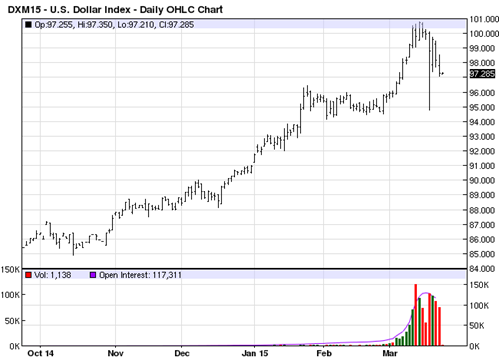

As proof of how fast things can move, look at the January Swiss National Bank (SNB) decision to drop the Eurodollar peg, or the one-day 500 basis point intraday swing the US Dollar Index (USDX)! – It reminds me of something Ian Teller once said, “I’m more of an opportunist than a visionary.” – a good way of looking at things! It is just not possible to predict the timing when the wheels are going to start falling off, bringing the whole thing to a screeching halt.

Linda: David, are you willing to look into your crystal ball – cloudy though it may be – and give us a solid prediction for this year?

David: As Moe Howard, my favorite philosopher, would say, “We shall see what we shall see!” So, here’s my ‘walk out on a limb’ moment…

I believe this year will mark the absolute end of the cyclical precious metals’ bear market that began in May, 2011, and the re-ignition of the Long-term SECULAR Bull Market in Gold and Silver. It is highly probable that the lows for the metals and mining stocks as a whole are in now, but even if they are not, I believe that by September, it will be apparent from the charts, that we are now ready to start the “movin’ on up” phase of a multi-year bull run. In a worst case “Plan ‘B’” scenario I could envision a new primary low being established by late June, then a higher low in late August. (This time-frame, c. August 23 if memory serves, would accord with an excellent study done some years ago by Reg Ogden (The Ultimate Gold Stock Trader), where he demonstrates that, on an annual basis, the miners tend to react just this way, and during this time-frame.

Regardless, I believe much of the smart money will have already established most of their positions by that time. Remember – these serially-successful investors are, to paraphrase Ian Telfer “opportunists, not prognosticators”.

It’s during times like this when Clint Eastwood’s comment many years ago after swimming ashore at night when a military plane he was a passenger on crashed off the coast of CA, rings true. He somehow navigated through kelp, waves and rock obstacles to make it ashore – a journey that if, I remember correctly, the pilot did not. When asked how he survived, he replied simply, “You’ve got to shut out the doubt.”

A Powerful now-is-the-time to own gold and silver signal

Linda, I would like to close our interview with two comments. The first is one my colleague, Jeff Clark made last month in a newsletter he edits for Casey Research. The second is from his boss. I think these two statements summarize accurately and succinctly both the problem and the great promise that people like your readers who hold precious metals are looking at as they steel themselves to keep doing what they know deep down inside to be right. Jeff said:

“We want to own gold when it’s in a global bull market. Gold rising in U.S. dollar terms alone doesn’t show us we have a real gold bull market. That could just mean the U.S. dollar is in a bear market. But gold rising against all four of the world’s major currencies – the U.S. dollar, euro, yen, and pound – shows we’re in a major gold bull market.”

And from his boss, Doug Casey, a man who has lived through – and made big money coming out of – as many resource sector cycles as anyone who is alive today. Recently Doug said:

“There’s no question that gold has had a severe retracement since its high in September of 2011. I understand the [gloomy]feelings. But we’re not talking about feelings here; we’re talking about markets. Markets cycle. This one has cycled about as low as any gold market in past corrections, and now I think it’s time for it to cycle up again.”

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.